Club President Melanie DeLuca asks GT Member Bob Erickson about the benefits of supporting Rotary using Qualified Minimum Distributions from an IRA

.

Melanie: Bob – as a person who has served as a CFO for multiple organizations and treasurer for many – I really value your financial wisdom and would love to have you share more about how our members who are 70.5 years of age or older can give to our club foundation or TRF (the Rotary Foundation) and save on their taxes.

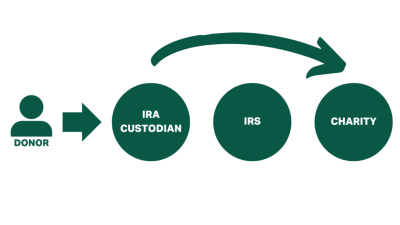

Bob: Once you have reached 70.5 years of age, members should consider making charitable contributions as Qualified Charitable Distributions from your IRA. When you make Qualified Charitable Distributions from your IRA, you exclude these contributions from your taxable income although you do not receive a charitable contribution deduction. In 2025, an individual may exclude up to $105,000 and a married couple may exclude $210,000. These Qualified Charitable Contributions also count as fulfilling your Required Minimum Distribution when you become 72.

Melanie: What kinds of organizations qualify?

Bob: To qualify as a Qualified Charitable Distribution, the funds must go directly to a 501(c)(3) Charity. Rotary Clubs are not 501(c)(3) organizations, but many clubs have created a 501(c)(3) foundation. Global Travelers is based in Rotary District 5950 which has a 501(c)(3) foundation that can accept donations on behalf of our club since we are a young club and have not yet established our own foundation.

Also, the Rotary Foundation (TRF) is a 501(c)(3) organization and you can also make your contribution to TRF as a Qualified Charitable Distribution. When you make a Qualified Charitable Distribution, the charity must receive funds directly from your IRA before December 31. The charity receiving your Qualified Charitable Distribution must provide you a written acknowledgment by April 15 of the following year for you to claim the Qualified Charitable Distribution on your tax return.

Also, the Rotary Foundation (TRF) is a 501(c)(3) organization and you can also make your contribution to TRF as a Qualified Charitable Distribution. When you make a Qualified Charitable Distribution, the charity must receive funds directly from your IRA before December 31. The charity receiving your Qualified Charitable Distribution must provide you a written acknowledgment by April 15 of the following year for you to claim the Qualified Charitable Distribution on your tax return.

Melanie: Are there different rules depending on what financial institution your IRA is with?

Bob: Each financial institution has different rules for making Qualified Charitable Distributions. You will need to consult with them about required procedures. My wife and I make most of our charitable donations as Qualified Charitable Distributions. Unless you have high mortgage interest or extremely high medical expenses, you probably no longer generate a tax deduction for you charitable contributions under current tax law. Most people now take the standard deduction instead. Excluding Qualified Charitable Distributions from taxable income can be much more advantageous than receiving a deduction for charitable contributions. This is a good time of year to discuss this with your financial advisor or tax preparer. It is important to note that this was written from the perspective of a Minnesota, USA resident.

Bob: Each financial institution has different rules for making Qualified Charitable Distributions. You will need to consult with them about required procedures. My wife and I make most of our charitable donations as Qualified Charitable Distributions. Unless you have high mortgage interest or extremely high medical expenses, you probably no longer generate a tax deduction for you charitable contributions under current tax law. Most people now take the standard deduction instead. Excluding Qualified Charitable Distributions from taxable income can be much more advantageous than receiving a deduction for charitable contributions. This is a good time of year to discuss this with your financial advisor or tax preparer. It is important to note that this was written from the perspective of a Minnesota, USA resident.

Melanie: Bob – I want to thank you for sharing your financial wisdom and for the dedication you and Nancy have made to Rotary Giving!